I shared on Tuesday what I've been reading in my devotionals and how I feel God is speaking to me.

It involves a lot about figuring what I'm called to do.

I'm really struggling with making sure I am in God's will.

Something is a'stirring in this heart of mine!

These things I have shared with Jason have lead to many discussions about getting healthy financially.

We are beginning to really take a look at and putting a plan together to get out of debt.

We want to be good stewards of what God has blessed us with

for what He is preparing us for.

I read blogs all the time of families who are getting out of debt.

I've know all about Dave Ramsey.

I know, I know, I know!

But do I DO!

Yes, It's time to do the do!

Snicker, snicker

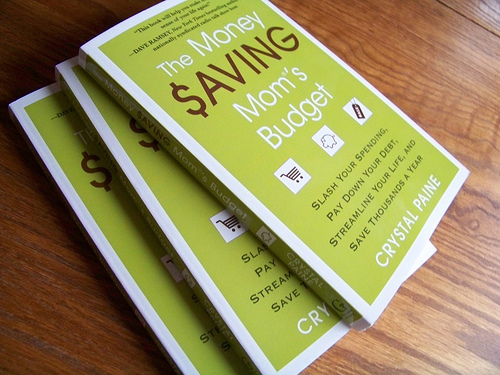

I read the blog,"Money Saving Mom.". Her site is just like it sounds, a place about saving money.

Side track: Go check out her site and read about what she is doing with all the proceeds of her new book.

Hint: Funding a whole program in the Dominican Republic.

Amazing how God has blessed her faithfulness!

What I appreciate most are the stories of how to live responsibly and helpful words from others who have worked their way out of debt.

I say work because I know that this journey will take work.

Here are two areas we are looking at first in regards to freeing up money.

Hasta la Vista Dish Network.

Say what?

This seems like an impossible sacrifice to make.

Just torture to the American way of life.

I mean, whatever will we do with our time.

I shared with Jason that we should look at it as a opportunity to spend more time together as a family

and to read, and to seek earnestly future paths we might take.

You should know we do have Netflix for the time being.

I am actually getting excited about it.

Weird. I might actually get work done.

To be honest I don't watch much tv.

It's only white noise for me.

I'm excited about the money we will be freeing up to pay off other debt.

Now, to just call Dish Network and let them know!

The second thing we need to do is get committed to planning our meals and eating at home.

With both of us working it gets really easy to pick something up for dinner

and chalk it up to be tired from a long day.

I've gone through and added up how much is spent eating out.

It's not pretty.

It's actually rather depressing.

So, we have to work on getting a schedule set for making dinner.

Commit to making it a priority not only for saving money but for being healthy role models to our kids.

This week the kids and I only at take out one night.

We had Little Caesar's at a whopping $7.00, and it was only because I had had it.

This was after the dead battery incident.

Do you have any helpful tips to share about cutting costs?

I could use all the advice and good tips I can get!

Finding the Blessings,

Denise

We are working on our finances too. We are still trying to decide what to cut back on. It's not easy. We did downgraded our tv from preminum channels (hbo, max, etc) to basic plan. That alone saved us $40 a month even after upgrading our internet speed.

ReplyDeleteWe are at around $13,000-15,000 in credit card debts. It sucks.